According to the definition of market value of a property, per international valuation standards (MAI), Red Book (MRICS), or §194 BauGB/ImmoWertV, it is the price that the majority of relevant investors are willing to pay under fully publicly available information without coercion or personal/special interests.

In real estate valuation, the essential parameters of location, property, and legal aspects, as well as a brief or comprehensive overview of the location/market and competitive situation (research), have been considered in market value appraisals.

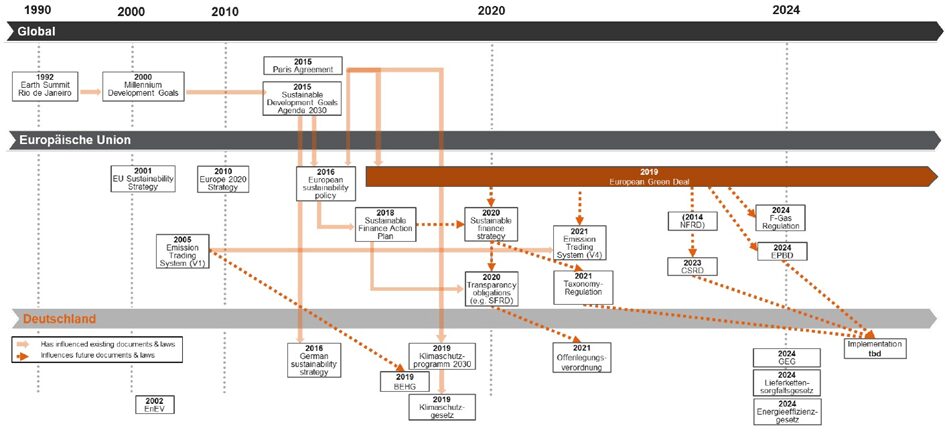

The current and anticipated requirements of the SFRD/CSRD/EPBD from the European Green Deal and energy targets outlined in the Paris Convention 2015, as well as national regulations, have significantly transformed the real estate landscape over the past decade. The emphasis on energy efficiency, social standards, transparency, and ethical principles is now all ingrained into the capital market, corporate philosophy, the real estate market and valuation methodologies; encapsulated under the umbrella term ESG.

The following chart summarizes the main developments in this regard:

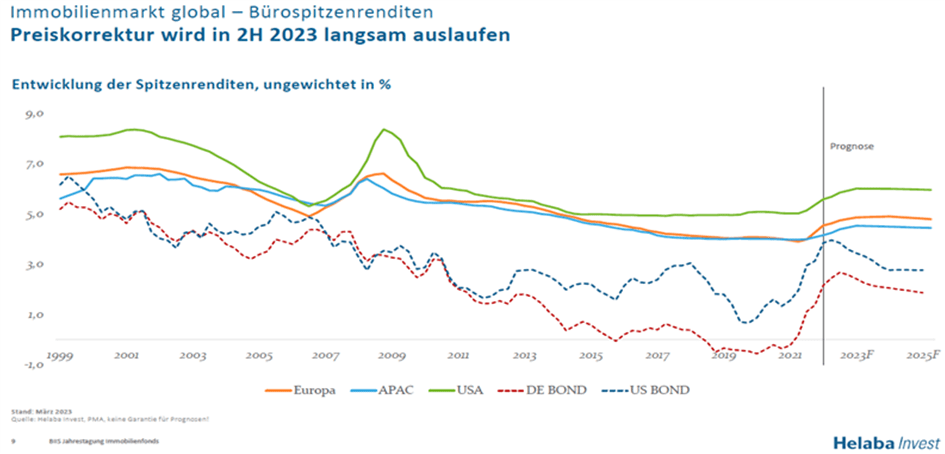

In addition, significant market distortions and changes occurred due to the ECB’s interest rate regulation from Q3/2022 onwards. Consequently, historical research data is predominantly outdated, and transactions in 2023 declined significantly, presenting a highly heterogeneous structure, which raises questions and problems for valuation and consulting.

The trend in interest rates over the past two decades illustrates a fundamental dependency of the gross initial yields of existing properties or the gross profit multipliers on the capital market level and alternative asset classes.

For real estate valuation and real estate-related consulting, this results in fundamentally extended requirements.

Implementation of ESG in the assessment

The incorporation of ESG criteria in market value appraisals fosters maximum transparency and establishes the groundwork for all market participants to access comprehensive information about the respective property on the capital market. Tools facilitating this include CRREM diagnosis and ISFP, ESG ratings, and the integration of key ESG parameters into earnings value, DCF calculation, and residual value calculation. Consequently, the ESG value parameters are reflected in the market value.

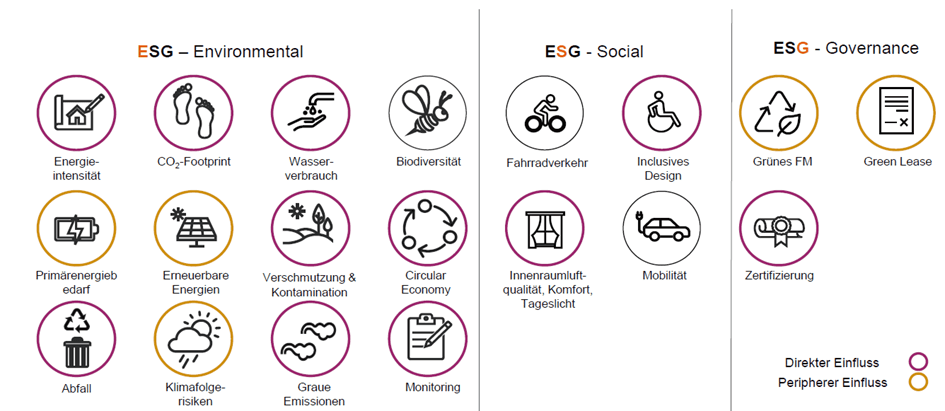

Among > 500 ESG criteria documented in various systems, we believe that the following key value-parameters are essential for determining market value:

In detail, it is evident that ESG criteria are integral to previous (though not conclusively defined) location, property, and market parameters that are crucial for property valuation. ESG serves to enhance clarity rather than to be a standalone criterion. The legislation and objectives at the European or national level themselves constitute the framework parameters that must be considered, given their respective market relevance.

In our view, the following are relevant in the transformation of ESG to rating systems:

- The integration of ESG factors into value parameters, such as remaining useful life (RND), rental rates, real estate interest rates in the income value method as outlined in ImmoWertV or adapted into models such as DCF/residual value, necessitates appropriate adjustments.

- The ESG rating serves as an additional qualification seal.

- If applicable, conducting Technical Due Diligence (TDD), Commercial Due Diligence (CDD), or ESG Due Diligence (ESG-DD) when available for the property, whilst simultaneously assessing their impact on the parameters mentioned above, within the context of their elimination. This could be documented, for example, via an Integrated Sustainability and Financial Performance (ISFP) report or a similar document.

- A certification seal for buildings signifies a clear acceptance of a certain quality in the market.

In Germany, certification systems for office and residential/new construction asset classes include BREEAM, LEED, DGNB, and WELL. For residential/older stock, the ISFP certification is utilized, while for brownfields, the Brownfield24 certificate is employed. Additional certificates may emerge in the market for this purpose.

Through statistical analysis of market transactions involving certified buildings, clear indicators of the relationship between returns and the level of certification in the medium term are being pursued. This is an ongoing area of research.

Arbitrage or Speculation: Calculations, Definitions, Research

A fundamental issue in defining market value is that this concept reflects market behavior rather than representing the maximum commercially appropriate value in its truest sense.

For real estate investments (including project development, portfolio construction, land mobilization, etc.), market value is not necessarily the most relevant variable concerning the maximum acceptable land purchase price or the equivalent value of a property. In fact, it can exacerbate what is colloquially referred to as the “lemmings’ problem.”

When there are no significant changes in the real estate market, considering market value alone poses minimal issues, especially when a delta is factored into the investment decision. However, when stronger market distortions such as capital market shifts or political changes occur, investors may either succumb to overvaluation trends and purchase properties at inflated prices, or fail to capitalize on genuine opportunities, resulting in a “full-throttle-full-brake” effect.

This scenario is particularly pronounced now due to changes in capital markets and European legislative directives, alongside other current issues. Real estate investments can no longer rely solely on historical data and comparative values. Instead, a comprehensive understanding of research and the reinterpretation of former benchmarks (such as rents, purchase prices, and multipliers) form the new basis for decision-making, depending on the asset class.

recapXX therefore pursues a more comprehensive approach in the field of valuation and consulting.

We undertake a comprehensive statistical analysis of all available market data to derive insights into demand, competition, and market conditions for specific locations, buildings, and asset classes, along with their relevant factors. While our analysis is grounded in past data, the evolution of the dataset reveals changes in parameters. Coupled with theoretical approaches, this enables us to make task-specific forecasts.

By overlaying various project calculations, we identify the arbitrage or speculative potential necessary for investment decisions, a crucial prerequisite for transactions in the market. Moreover, this process fosters an understanding among market participants of the new dynamics in the real estate market, facilitating movement and informed decision-making.

In the three classical groups, the following are analyzed:

Project developments (new construction / revitalizations): Residual value calculations, which are classic market value tools in project evaluation, are juxtaposed with project development calculations of investors and aligned as closely as possible. Through the analysis of these methodologically different approaches, we extract information to identify arbitrage or speculative potentials.

Existing properties: DCF calculations, a classic tool for inventory valuation, are overlaid onto comprehensive financial calculations (VoFi) in commercial investment analysis. Concurrently, maintenance backlogs are compared within the framework of Technical Due Diligence (TDD), Carbon Due Diligence (Carbon-DD), and ESG Due Diligence to avoid duplicate considerations. This analysis of the two different approaches identifies risks and potentials that form the basis of an investment decision.

Brownfields, Greenfields: The classic valuation method of “deductive land value determination” is overlaid onto a VoFi to transparently determine risks and opportunities in building land mobilization, which can be substantial. This process aims to clearly identify location and usage potentials with regard to actual feasibility.

Overall, the demands for market value appraisals have significantly increased due to regulations and market shifts. In our perspective, innovative approaches and close networking within the real estate sectors lay the foundation for meeting the current demand for information and advice.